April 16, 2021

Prescience Point Launches Proxy Fight at MiMedx

Prescience Point Capital Management, together with its affiliates (“Prescience Point”), a research-focused, catalyst-driven investment firm, announced today the nomination of four highly qualified director candidates to the Board of Directors (the “Board”) of MiMedx Group, Inc. (NASDAQ: MDXG) (“MiMedx” or the “Company”). Prescience Point, a beneficial owner of approximately 8.1% of the outstanding shares of MiMedx, believes that the best path forward for unlocking shareholder value is the addition of Mr. Eiad Asbahi, Mr. Alfred G. Merriweather, Ms. Charlotte E. Sibley, and Mr. William F. Spengler to the Board at the upcoming Annual Meeting of Shareholders (the “Annual Meeting”), scheduled to be held on May 27, 2021.

“We continue to believe that MiMedx is deeply undervalued, due in large part to the Company’s failure to effectively communicate the value of Amniofix to the investment community,” said Eiad Asbahi, Founder and Managing Partner of Prescience Point. “Furthermore, under the current Board’s oversight, power has become concentrated in the hands of one entity, rendering the Board incapable of unlocking the Company’s substantial value for all shareholders.”

“To realize the promise of MiMedx for all shareholders, the Company needs – first and foremost – a reconstituted Board that will help direct the Company to craft a more compelling story for investors and who will advocate for the best interests of ALL shareholders, not a select few,” Mr. Asbahi added.

Prescience Point also announced that it has issued an open letter to MiMedx shareholders, the full text of which follows below:

Dear Fellow MiMedx Shareholders,

Prescience Point Capital Management, together with its affiliates (“Prescience Point”), currently owns approximately 8.1% of the outstanding shares of MiMedx Group, Inc. (“MDXG” or the “Company”), making us one of the Company’s largest shareholders. We continue to believe that MDXG is deeply undervalued. However, under the current Board’s oversight, we believe that power has become concentrated in the hands of one entity, EW Healthcare Partners (“EW”), rendering the Board incapable of unlocking the Company’s substantial value for all shareholders.

As a significant, long-term owner of MDXG, we have helped create immense value for all shareholders through our activism efforts. Most notably, since 2018, we believe that we have played a vital role in helping MDXG to not only survive the financial and reputational fallout created by its accounting scandal – but also to transform itself into a much stronger company that is better positioned for sustained success.

Since then, shareholders have seen an increase in MDXG’s share price from roughly $3.00 per share just prior to the start of our activist efforts, to $12.30 per share at yesterday’s close. Even still, this valuation remains, in our view, far below the more than $30.00[i] per share that we believe the Company should be worth right now, based on the enormous potential of its Amniofix injectable product.

To realize the promise of MDXG for all shareholders, we believe that the Company needs – first and foremost – a Board of Directors that is fully committed to continuing the process of unlocking value that Prescience Point began nearly two and a half years ago. That is why we have nominated a slate of four highly qualified candidates for election to the Company’s Board of Directors (the “Board”) at the Annual Meeting of Shareholders (the “Annual Meeting”), scheduled to be held on May 27, 2021. Our nominees will represent the interests of ALL MiMedx shareholders, not a select few. We urge all shareholders to ensure their voice can be heard in this upcoming Board election by ensuring their shares have not been lent out by their broker to other parties.

The Potential of a Game-Changing Product Remains Hidden, Resulting In Chronic Undervaluation

Prescience Point has remained a significant shareholder of MDXG in large part because of the immense promise of Amniofix. As detailed in our December 16, 2020 report, our research overwhelmingly indicates, and we strongly believe, that Amniofix will be a game-changing, multi-billion dollar treatment for knee osteoarthritis (“knee OA”) and other musculoskeletal ailments.

Unfortunately, it is our belief that MDXG’s management and Board have consistently failed to effectively convey the potential of this product to the investment community. For the past two years, in letters and private conversations, we have repeatedly urged management and the Board to be more vocal and transparent about Amniofix. Yet, despite repeated assurances to us by management that things would change, it seems that nothing has, resulting in the chronic undervaluation of MDXG equity.

Shareholders should be concerned by the Company’s puzzling reluctance to provide meaningful information about Amniofix when communicating with investors. To the extent MDXG has released information, the data has been overly conservative and incomplete, and severely downplayed the product’s potential, amounting in our view to misrepresentation. Look no further than the JP Morgan Healthcare Conference presentation, where the Company estimates the addressable market for Amniofix at just 1-1.5 million knee OA patients, despite the fact that there are almost 20 million knee OA patients in the US alone. Given blunders such as these, it is not surprising that almost every time the Company has spoken publicly about its business during the past two years, its share price has subsequently declined.

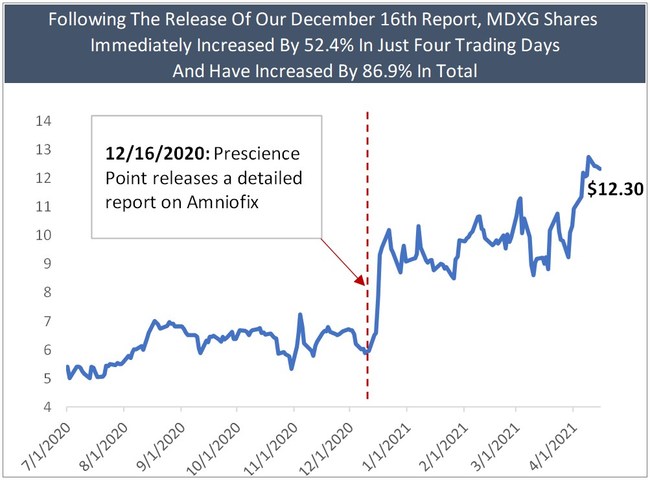

In contrast to the Company’s failure to effectively tell its story to investors, consider the market’s enthusiastic reaction to our December report on Amniofix. Prior to the publication of our report, the market was assigning little-to-no value to Amniofix, and MDXG shares were languishing in the $5 to $6 range. Immediately following our report’s release, MDXG shares increased by 52% in the span of just four trading days, from $6.58 on December 15, 2020 to $10.03 on December 21st, 2020, in what we believe to be a clear indictment of management’s inability to communicate the Company’s potential for value-creation. This upward momentum has continued in 2021, and MDXG shares are currently trading at $12.30.

Board and Management Decisions Have Destroyed Shareholder Value

Additionally, the current management and Board have made what we view to be baffling strategic decisions which have destroyed significant shareholder value. In July of last year, despite our objections and offer to help it raise capital at a more opportune time, the Company raised $150 million of hugely dilutive capital from private equity firms EW and Hayfin Capital Management in the form of $100 million of convertible preferred stock and a $50 million term loan. Given the fact that, at the time, MDXG shares were trading at just $5.40 and the Company had almost $50 million of cash on its balance sheet, we believe this capital raise was excessive, ill-timed and, frankly, completely unnecessary. Even worse, the preferred shares were issued with a strike price of just $3.85, which was almost 30% lower than the share price at that time! We cannot recall ever seeing another convertible deal consummated at such a deep discount.

We are also troubled by management’s comments during recent investor conferences that it intends to actively pursue M&A opportunities in the wound care space. Given that the value of Amniofix greatly exceeds that of the wound care business, we believe this strategy is misdirected as it reflects a misunderstanding of the value drivers of the business and would be highly value destructive. In order to finance such a strategy, the Company would likely have to issue yet more shares, which would effectively transfer much of the value of Amniofix from existing shareholders to new shareholders. To engage in such M&A “empire building,” which is characteristic of a private equity “playbook,” would be extremely distracting to the Company and further destructive of shareholder value.

MDXG Has Lost Significant Market Share to Organogenesis

MDXG’s financial performance has also been disappointing. The Company reported an 11% year-over-year decline in sales in FY 2020 and has guided for a ~10% increase in sales in FY 2021. By contrast, Organogenesis (“ORGO”) reported a 30% year-over-year increase in sales in FY 2020 and has guided for a 20% increase in sales in FY 2021. Said more simply, MDXG has lost and continues to lose significant market share to ORGO. Not surprisingly, ORGO’s share price has dramatically outperformed that of MDXG and is up more than 600% over the past 12 months.

Recent Board Addition Gives EW Healthcare an Outsized Influence Over the Company

We are deeply troubled by the Board’s recent decision to add a former EW affiliate, Dr. Phyllis Gardner, to its ranks. This addition was made shortly after we had expressed our desire to the Company to work cooperatively in reconstituting the Board with new members who would advocate for the best interests of all shareholders. Rather than engaging productively with us to achieve this goal, the Board instead responded by further entrenching its interests and those of EW, while stripping shareholders of the opportunity for true representation.

With Dr. Gardner’s addition, 33% (three out of nine) of the seats on the Board are now held by current or former affiliates of EW, which far exceeds EW’s percentage ownership in the Company. As a private equity firm, EW’s interests may not align with those of public shareholders. For example, based on our conversations with Martin P. Sutter and William A. Hawkins III, EW representatives on the Board, we believe that EW is likely the driving force behind the Company’s value-destructive pursuit of acquisitions in the wound care space. The entire MDXG Board must be held accountable for allowing EW to build such an outsized influence over the Company’s direction.

It has become abundantly clear to us that MDXG needs additional representatives on the Board who will advocate for the best interests of ALL shareholders and who can direct the Company to craft a more compelling narrative about Amniofix for the investment community and court potential strategic partners. If the current course is not changed, and the Board is not reconstituted, we believe EW will continue to pack the Board. Thus, MDXG will not reach its full potential and its shares will continue to fail to reflect the true value of the business.

We did engage the Company in an effort to reach a consensual solution, and are disappointed that members of management and the Board refused our reasonable request for meaningful Board representation that better reflects the interests of public shareholders. As a result, we are compelled to take the step of nominating a new slate of candidates for election to the Board.

Our four highly-qualified, diverse and independent nominees, including one representative from Prescience Point, are committed to rigorous oversight of the Company’s management, operations, business strategy, and value-creation process. Importantly, our three non-Prescience nominees collectively have decades of experience as executives and directors of well-performing biopharma companies, many of which were eventually sold on their watch. We have provided detailed biographies of each of our nominees below.

Biographies of Prescience Point’s Nominees (in alphabetical order):

Eiad Asbahi

Mr. Eiad Asbahi is currently the managing member of Prescience Point Capital Management, LLC, which he founded in 2009. Prior to founding Prescience Point, Mr. Asbahi was a consultant with the investment firm Kinderhook Partners from 2008 to 2009. At Kinderhook, Mr. Asbahi focused exclusively on analyzing small-cap equities, identifying undervalued companies with exceptional growth prospects or impending catalysts to unlock intrinsic value. Before his time at Kinderhook, Mr. Asbahi served as a consultant at Cohanzick Management in 2008, analyzing companies across the capital structure, with a focus on high yield and distressed debt, capital arbitrage and special situation equities. Mr. Asbahi began his career as an analyst with Sand Spring Capital in 2004, where he worked until 2008. He received a B.S. in Microbiology from Louisiana State University, summa cum laude, his MBA from Louisiana State University in 2006, graduating at the top of his class, and is a Chartered Financial Analyst (CFA®) holder.

Alfred G. Merriweather

Mr. Alfred G. Merriweather is currently a retired financial executive. Since January 2021, he has served as director, chair of the Board and chair of the Audit Committee of Cadex Genomics, Corp., a privately held molecular diagnostic company. Mr. Merriweather has spent over thirty years in chief financial officer roles in a number of life science and medical technology companies. Most recently, from 2017 to 2019, he was the CFO of Adamas Pharmaceuticals, Inc., a publicly traded pharmaceutical company focused on neurologic disorders. Prior to his employment by Adamas, Mr. Merriweather served as CFO of RainDance Technologies, Inc., a life science tools company, from 2013 to 2017. Mr. Merriweather has also served as CFO to several other device, tools, and diagnostic companies. These include clinical lab companies such as Verinata Health, Inc., Celera Corporation and Monogram BioSciences, Inc., as well as the medical device companies Laserscope and Symphonix Devices Inc. He began his career with Price Waterhouse as a chartered accountant in London, England and San Jose, California, and received his B.A. in Economics from the University of Cambridge in 1975.

Charlotte E. Sibley

Ms. Charlotte E. Sibley is currently the President of Sibley Associates, LLC. Since 2018, she has also served on the board of directors of Advicenne, SA, a publicly-traded French specialty pharmaceutical company, where she was a member of the Remuneration Committee. Currently, Ms. Sibley is also a director and chair of the Compensation Committee of the Fort Hill Company, a position she has held since 2015. Ms. Sibley has over forty years of experience in the biopharmaceutical industry. Recently, she served on the board of directors of Taconic Biosciences, Inc., from 2013 to 2019 where she chaired the Nomination and Governance Committee. Prior to Taconic, Ms. Sibley was a director of the American Pacific Corporation from 2010 to 2014. Ms. Sibley began her career in the pharmaceutical industry as a market research manager for Pfizer in 1970, and held several managerial positions at companies such as Johnson & Johnson, the Medical Economics Company, and Bristol-Myers Squibb, and later held executive positions at Pfizer, Millennium Pharmaceuticals, and Shire plc. Ms. Sibley received her A.B. in French Language and Literature from Middlebury College in 1968 and her MBA from the University of Chicago Booth School of Business in 1970.

William F. Spengler

Mr. William F. Spengler is currently retired and working part time as a partner for Frederick Fox, LLC, an executive search firm, a position he has held since May 2020. Prior to his retirement, Mr. Spengler served on the board of directors of Endo International plc, a publicly traded pharmaceutical company, from 2008 to 2017. While on the board, Mr. Spengler was chair of the Audit Committee and a member of the Research & Development Committee. He has 14 years of experience as chief financial officer of multiple companies, including Smith & Wesson Brands Inc., MGI Pharma, Inc., and Guilford Pharmaceuticals, Inc., Earthshell Corporation, and Sweetheart Holdings. He also served as president of Chromadex from 2012 to 2015 and Osteo Implant Technologies from 2001 to 2003. Mr. Spengler began his career with Bristol-Myers Squibb, where he worked for fourteen years, before serving as vice president of finance in the International Group and later the Power Tools Group of Black and Decker, before moving to the Sweetheart Cup Company. Mr. Spengler received his MBA from the New York University Stern School of Business in 1980 and his B.A. in Economics from Yale University in 1977.

We believe the addition of the above nominees to the Board is critical to help put MDXG on the right path to maximize value for all shareholders.

For updates and shareholder information, follow @PresciencePoint on Twitter or www.presciencepoint.com

Sincerely,

Eiad Asbahi

Prescience Point Capital Management, LLC

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Prescience Investment Group, LLC d/b/a Prescience Point Capital Management LLC, Prescience Partners, LP, Prescience Point Special Opportunity LP, Prescience Capital, LLC, Eiad Asbahi, Alfred G. Merriweather, Charlotte E. Sibley and William F. Spengler (all of the foregoing, collectively the “Participants”) intend to file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of GOLD proxy to be used in connection with the solicitation of proxies from the shareholders of MiMedx Group, Inc. (the “Company”). All shareholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying GOLD proxy card will be furnished to some or all of the Company’s shareholders and will be, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in a Schedule 14A filed by the Participants with the Securities and Exchange Commission on April 16, 2021. This document is available free of charge from the source indicated above.

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release are for general information only and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this presentation in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Prescience Point disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.

About Prescience Point Capital Management

Prescience Point Capital Management is a private investment manager that employs forensic investigative techniques to unearth significant mispricing in global markets. It specializes in extensive investigations of difficult-to-analyze public companies in order to uncover significant elements of the business that have been overlooked or ignored by others.

Prescience Point manages private funds on behalf of its clients and principals and takes positions both long and short in support of its research. Prescience Point invests across a broad set of equities that it believes have abnormally large disparities between what their underlying businesses are intrinsically worth and what their securities sell for. The firm was founded by investor Eiad Asbahi in 2009 and is headquartered in Baton Rouge, LA. Prescience Point Capital Management is a registered investment advisor with the State of Louisiana. Follow @PresciencePoint.

Investor Contacts

Jason Alexander / Bruce Goldfarb

Okapi Partners LLC

212-297-0720

info@okapipartners.com