Posts Tagged ‘MDXG’

Prescience Point To WITHHOLD Votes for MiMedx Directors and Vote AGAINST the Advisory Approval of Executive Compensation

BATON ROUGE, La., May 6, 2022 — Prescience Point Capital Management LLC (“Prescience Point”), a research-focused, catalyst-driven investment firm that beneficially owns approximately 6.7% of the outstanding common stock of MiMedx Group, Inc. (“MDXG” or the “Company”) (NASDAQ: MDXG), today issued an open letter to shareholders announcing its intent to WITHHOLD its votes against two members of MDXG’s Board of Directors, Phyllis Gardner and James Bierman, who are up for election at the Company’s annual meeting of shareholders on June 7, 2022.

“MDXG’s share price is down over 70% from its peak less than a year ago, largely as a result of mismanaged clinical trials, value-destructive decisions, and poor investor communication, among other failures. Yet the Board recently granted millions of dollars in stock to CEO Tim Wright and other members of the Company’s senior leadership team,” said Eiad Asbahi, Founder and Managing Partner of Prescience Point.

“Under the Board’s oversight, management has aligned itself with, and power has become overly concentrated into, the hands of a private equity firm, EW Healthcare Partners (“EW”). This has resulted in the Company being run primarily for the benefit of two factions – EW and management – at the expense of the broader shareholder base. We believe shareholders deserve a truly representative Board that will make sound, value-creating decisions in the best interests of ALL shareholders. It is critically important that we all send a clear message through our WITHHOLD votes that continued underperformance, excessive compensation, and value-destructive actions of the Board and management will not be tolerated. This will also help set the stage for next year’s shareholder meeting, where four Board seats will be up for election,” added Mr. Asbahi.

The full text of the letter follows:

May 6, 2022

Dear Fellow MiMedx Shareholders:

Prescience Point Capital Management LLC, together with its affiliates (“Prescience Point”), beneficially owns approximately 6.7% of the outstanding shares of MiMedx Group, Inc. (“MDXG” or the “Company”), making us one of the Company’s largest shareholders. Despite gross mismanagement by the current regime, we continue to believe that MiMedx has an exciting future as a leader in the regenerative medicine space. Based on the extremely positive results from the first cohort of the Company’s Phase 2b knee osteoarthritis (OA) trial, we also continue to believe that Amniofix will be a game-changing, disease-modifying treatment for knee OA, with peak sales of over $15 billion.

For the past two and a half years, Prescience Point has worked diligently to create value for all MDXG shareholders. It is extremely distressing to see our constructive efforts repeatedly thwarted by the ill-conceived actions of the Company’s leadership team and Board of Directors, whose strategic missteps, inept public messaging, and poor governance have led to a chronic undervaluation of MDXG’s equity.

After being asked on its recent earnings call why the market consistently undervalues MDXG compared to its peers, CEO Tim Wright said: “I don’t know exactly what is missing here from an investor viewpoint.”

We agree with CEO Wright. Management does not know what investors want, and that is clearly reflected in MDXG shares, which are currently trading at a massive discount to fair value. Inexplicably, despite management’s dismal performance, the Board, including James Bierman, the Chair of the Compensation Committee, awarded management an excessive and undeserved windfall, including a 603,000 restricted share grant worth almost $3 million to CEO Wright.

That alone should merit sending a message to the Board that the current status quo has to change. It is also worth noting that, despite MDXG’s chronically languishing share price, not one member of management or the Board has ever stepped up to buy a single MDXG share with their own money since joining the Company.

IT IS TIME TO HOLD THE MIMEDX BOARD ACCOUNTABLE

For all of the reasons stated herein, we intend to vote “WITHHOLD ALL” to reject the election of Directors James Bierman and Phyllis Gardner and vote “AGAINST” the advisory approval of executive compensation, to register our dissatisfaction with the disastrous governance and direction of the Company. Our hope is that all shareholders understand the importance of withholding votes against these incumbent directors at the 2022 Annual Meeting in order to demonstrate that the status quo is unacceptable.

In our opinion, there are numerous examples of the Board’s and management’s disregard of shareholders’ interests:

Poor Investor Communication. MiMedx has failed to communicate the value of its wound care business and the immense promise of its premier asset – Amniofix – to the investment community. Management has continuously downplayed the peak sales potential of Amniofix by communicating a total addressable market (“TAM”) for the product that is a fraction of its true size. For example, during its recent presentation at the Canaccord Genuity Musculoskeletal Conference, CEO Tim Wright inexplicably estimated that the TAM for Amniofix is just $1.3 billion to $1.5 billion, implying that the product’s peak sales potential is just a few hundred million dollars. This type of inept messaging by management has led the markets to largely ignore and assign little value to the Company’s pipeline.

Given the fact that a majority of clinical-stage biotechnology companies are either sold or sign a partnership prior to running a Phase 3 trial, we believe there is a good chance that MDXG will pursue strategic alternatives for its Amniofix asset later this year. As such, we believe it is imperative that the Company rectify its inability to effectively communicate its story and other lingering issues ahead of these potential negotiations.

Egregiously Excessive Management Compensation. Despite management’s consistent track record of shareholder value destruction, the Board has awarded executive compensation that is unjustified by performance and far exceeds what is paid by comparable companies. In fiscal years 2020 and 2021, CEO Tim Wright’s total compensation was $4.7 million and $4.8 million, respectively. That was almost 2x the average compensation paid to CEOs of public companies with comparable annual sales. Furthermore, on April 8, 2022, with MDXG shares down more than 70% since September 10 and trading near their 52-week lows, the Board awarded management an excessive and undeserved share grant, including a 603,000 restricted share grant worth almost $3 million to CEO Wright. A WITHHOLD vote to reject Director James Bierman, who chairs the Compensation Committee, and a vote AGAINST the advisory approval of executive compensation would send a strong signal that shareholders will not tolerate this irresponsible behavior.

Inequitable Concentration of Board Influence. Under the current Board’s oversight, power has become overly concentrated in the hands of EW. Current or former EW affiliates hold 33% (three out of nine) of the Board seats, which we believe is not justified by EW’s share ownership of approximately 18%. As a preferred stock holder in the Company and a private equity firm, EW’s incentives are different, and its investment time horizon is likely much longer than those of the broader shareholder base, creating a severe conflict of interest. We are concerned that EW could use its oversized influence on the Board to block a potential sale of Amniofix or the entire business later this year, resulting in the Company squandering a potentially massive value-creative window for its long suffering shareholder base. A WITHHOLD vote against Director Phyllis Gardner, who is a former EW affiliate, would send a strong signal that shareholders will not tolerate this misalignment of interests.

Mismanaged Clinical Trials. Under the current Board and management, MDXG has badly mismanaged its clinical trials, which directly led to the disappointing results of both its Phase 2b knee OA and Phase 3 plantar fasciitis trials. To be more specific, the second patient cohort of both the Phase 2b knee OA and Phase 3 plantar fasciitis trials performed poorly because the patients in the treatment arm were given expired Amniofix product. This extremely careless error directly resulted in a 60% decline in MDXG’s share price on the day the results were announced. Rather than accept responsibility for mismanaging the clinical trials, the current Board and management have tried to deflect blame by claiming that poor trial design by prior management was the reason for the failure of the studies. We view this lack of accountability as deeply troubling.

Value Destructive EW Transaction. Despite having more than sufficient liquidity and covenant cushion to fund itself for the next 12+ months, in July 2020, MDXG raised $150 million of highly dilutive capital from EW and Hayfin Capital Management, including $100 million of preferred stock ($90 million from EW, $10 million from Hayfin) and a $50 million term loan (entirely funded by Hayfin). To make matters worse, with its shares trading near their pandemic low at just $5.40, MDXG inexplicably agreed to issue the $100 million of preferred stock with a conversion price of just $3.85, representing a discount of 28.7%. This excessive, unnecessary, and incredibly value destructive transaction epitomizes the lack of regard that the current Board and management have shown for the best interests of shareholders.

We continue to believe that MiMedx has tremendous potential to enhance shareholder value through its promising product pipeline and wound care business. However, we also believe that the failure of the Board and management to act in the best interests of MDXG shareholders will continue to be a major obstacle to value-creation.

We feel that it is imperative to make abundantly clear our dissatisfaction with the status quo, which is why we intend to vote “Withhold” against the incumbent directors standing for re-election and “Against” the advisory approval of executive compensation. Our hope is that long-serving incumbents are held accountable at the Annual Meeting.

Respectfully,

Eiad Asbahi, Founder

Prescience Point Capital Management

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release are for general information only and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this presentation in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Prescience Point disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.

About Prescience Point Capital Management

Prescience Point Capital Management is a private investment manager that employs forensic investigative techniques to unearth significant mispricing in global markets. It specializes in extensive investigations of difficult-to-analyze public companies in order to uncover significant elements of the business that have been overlooked or ignored by others.

Prescience Point manages private funds on behalf of its clients and principals and takes positions both long and short in support of its research. Prescience Point invests across a broad set of equities that it believes have abnormally large disparities between what their underlying businesses are intrinsically worth and what their securities sell for. The firm was founded by investor Eiad Asbahi in 2009 and is headquartered in Baton Rouge, LA. Prescience Point Capital Management is a registered investment advisor with the State of Louisiana. Follow @PresciencePoint.

Investor Contact:

Media Contact:

Dukas Linden Public Relations

646-808-3665

Prescience Point Launches Proxy Fight at MiMedx

Prescience Point Capital Management, together with its affiliates (“Prescience Point”), a research-focused, catalyst-driven investment firm, announced today the nomination of four highly qualified director candidates to the Board of Directors (the “Board”) of MiMedx Group, Inc. (NASDAQ: MDXG) (“MiMedx” or the “Company”). Prescience Point, a beneficial owner of approximately 8.1% of the outstanding shares of MiMedx, believes that the best path forward for unlocking shareholder value is the addition of Mr. Eiad Asbahi, Mr. Alfred G. Merriweather, Ms. Charlotte E. Sibley, and Mr. William F. Spengler to the Board at the upcoming Annual Meeting of Shareholders (the “Annual Meeting”), scheduled to be held on May 27, 2021.

“We continue to believe that MiMedx is deeply undervalued, due in large part to the Company’s failure to effectively communicate the value of Amniofix to the investment community,” said Eiad Asbahi, Founder and Managing Partner of Prescience Point. “Furthermore, under the current Board’s oversight, power has become concentrated in the hands of one entity, rendering the Board incapable of unlocking the Company’s substantial value for all shareholders.”

“To realize the promise of MiMedx for all shareholders, the Company needs – first and foremost – a reconstituted Board that will help direct the Company to craft a more compelling story for investors and who will advocate for the best interests of ALL shareholders, not a select few,” Mr. Asbahi added.

Prescience Point also announced that it has issued an open letter to MiMedx shareholders, the full text of which follows below:

Dear Fellow MiMedx Shareholders,

Prescience Point Capital Management, together with its affiliates (“Prescience Point”), currently owns approximately 8.1% of the outstanding shares of MiMedx Group, Inc. (“MDXG” or the “Company”), making us one of the Company’s largest shareholders. We continue to believe that MDXG is deeply undervalued. However, under the current Board’s oversight, we believe that power has become concentrated in the hands of one entity, EW Healthcare Partners (“EW”), rendering the Board incapable of unlocking the Company’s substantial value for all shareholders.

As a significant, long-term owner of MDXG, we have helped create immense value for all shareholders through our activism efforts. Most notably, since 2018, we believe that we have played a vital role in helping MDXG to not only survive the financial and reputational fallout created by its accounting scandal – but also to transform itself into a much stronger company that is better positioned for sustained success.

Since then, shareholders have seen an increase in MDXG’s share price from roughly $3.00 per share just prior to the start of our activist efforts, to $12.30 per share at yesterday’s close. Even still, this valuation remains, in our view, far below the more than $30.00[i] per share that we believe the Company should be worth right now, based on the enormous potential of its Amniofix injectable product.

To realize the promise of MDXG for all shareholders, we believe that the Company needs – first and foremost – a Board of Directors that is fully committed to continuing the process of unlocking value that Prescience Point began nearly two and a half years ago. That is why we have nominated a slate of four highly qualified candidates for election to the Company’s Board of Directors (the “Board”) at the Annual Meeting of Shareholders (the “Annual Meeting”), scheduled to be held on May 27, 2021. Our nominees will represent the interests of ALL MiMedx shareholders, not a select few. We urge all shareholders to ensure their voice can be heard in this upcoming Board election by ensuring their shares have not been lent out by their broker to other parties.

The Potential of a Game-Changing Product Remains Hidden, Resulting In Chronic Undervaluation

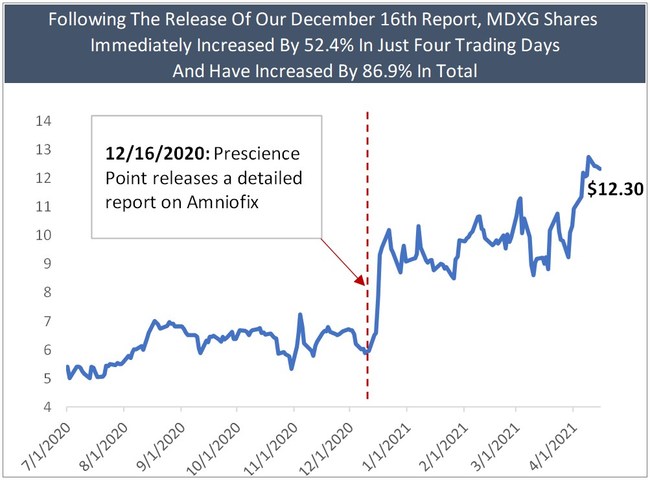

Prescience Point has remained a significant shareholder of MDXG in large part because of the immense promise of Amniofix. As detailed in our December 16, 2020 report, our research overwhelmingly indicates, and we strongly believe, that Amniofix will be a game-changing, multi-billion dollar treatment for knee osteoarthritis (“knee OA”) and other musculoskeletal ailments.

Unfortunately, it is our belief that MDXG’s management and Board have consistently failed to effectively convey the potential of this product to the investment community. For the past two years, in letters and private conversations, we have repeatedly urged management and the Board to be more vocal and transparent about Amniofix. Yet, despite repeated assurances to us by management that things would change, it seems that nothing has, resulting in the chronic undervaluation of MDXG equity.

Shareholders should be concerned by the Company’s puzzling reluctance to provide meaningful information about Amniofix when communicating with investors. To the extent MDXG has released information, the data has been overly conservative and incomplete, and severely downplayed the product’s potential, amounting in our view to misrepresentation. Look no further than the JP Morgan Healthcare Conference presentation, where the Company estimates the addressable market for Amniofix at just 1-1.5 million knee OA patients, despite the fact that there are almost 20 million knee OA patients in the US alone. Given blunders such as these, it is not surprising that almost every time the Company has spoken publicly about its business during the past two years, its share price has subsequently declined.

In contrast to the Company’s failure to effectively tell its story to investors, consider the market’s enthusiastic reaction to our December report on Amniofix. Prior to the publication of our report, the market was assigning little-to-no value to Amniofix, and MDXG shares were languishing in the $5 to $6 range. Immediately following our report’s release, MDXG shares increased by 52% in the span of just four trading days, from $6.58 on December 15, 2020 to $10.03 on December 21st, 2020, in what we believe to be a clear indictment of management’s inability to communicate the Company’s potential for value-creation. This upward momentum has continued in 2021, and MDXG shares are currently trading at $12.30.

Board and Management Decisions Have Destroyed Shareholder Value

Additionally, the current management and Board have made what we view to be baffling strategic decisions which have destroyed significant shareholder value. In July of last year, despite our objections and offer to help it raise capital at a more opportune time, the Company raised $150 million of hugely dilutive capital from private equity firms EW and Hayfin Capital Management in the form of $100 million of convertible preferred stock and a $50 million term loan. Given the fact that, at the time, MDXG shares were trading at just $5.40 and the Company had almost $50 million of cash on its balance sheet, we believe this capital raise was excessive, ill-timed and, frankly, completely unnecessary. Even worse, the preferred shares were issued with a strike price of just $3.85, which was almost 30% lower than the share price at that time! We cannot recall ever seeing another convertible deal consummated at such a deep discount.

We are also troubled by management’s comments during recent investor conferences that it intends to actively pursue M&A opportunities in the wound care space. Given that the value of Amniofix greatly exceeds that of the wound care business, we believe this strategy is misdirected as it reflects a misunderstanding of the value drivers of the business and would be highly value destructive. In order to finance such a strategy, the Company would likely have to issue yet more shares, which would effectively transfer much of the value of Amniofix from existing shareholders to new shareholders. To engage in such M&A “empire building,” which is characteristic of a private equity “playbook,” would be extremely distracting to the Company and further destructive of shareholder value.

MDXG Has Lost Significant Market Share to Organogenesis

MDXG’s financial performance has also been disappointing. The Company reported an 11% year-over-year decline in sales in FY 2020 and has guided for a ~10% increase in sales in FY 2021. By contrast, Organogenesis (“ORGO”) reported a 30% year-over-year increase in sales in FY 2020 and has guided for a 20% increase in sales in FY 2021. Said more simply, MDXG has lost and continues to lose significant market share to ORGO. Not surprisingly, ORGO’s share price has dramatically outperformed that of MDXG and is up more than 600% over the past 12 months.

Recent Board Addition Gives EW Healthcare an Outsized Influence Over the Company

We are deeply troubled by the Board’s recent decision to add a former EW affiliate, Dr. Phyllis Gardner, to its ranks. This addition was made shortly after we had expressed our desire to the Company to work cooperatively in reconstituting the Board with new members who would advocate for the best interests of all shareholders. Rather than engaging productively with us to achieve this goal, the Board instead responded by further entrenching its interests and those of EW, while stripping shareholders of the opportunity for true representation.

With Dr. Gardner’s addition, 33% (three out of nine) of the seats on the Board are now held by current or former affiliates of EW, which far exceeds EW’s percentage ownership in the Company. As a private equity firm, EW’s interests may not align with those of public shareholders. For example, based on our conversations with Martin P. Sutter and William A. Hawkins III, EW representatives on the Board, we believe that EW is likely the driving force behind the Company’s value-destructive pursuit of acquisitions in the wound care space. The entire MDXG Board must be held accountable for allowing EW to build such an outsized influence over the Company’s direction.

It has become abundantly clear to us that MDXG needs additional representatives on the Board who will advocate for the best interests of ALL shareholders and who can direct the Company to craft a more compelling narrative about Amniofix for the investment community and court potential strategic partners. If the current course is not changed, and the Board is not reconstituted, we believe EW will continue to pack the Board. Thus, MDXG will not reach its full potential and its shares will continue to fail to reflect the true value of the business.

We did engage the Company in an effort to reach a consensual solution, and are disappointed that members of management and the Board refused our reasonable request for meaningful Board representation that better reflects the interests of public shareholders. As a result, we are compelled to take the step of nominating a new slate of candidates for election to the Board.

Our four highly-qualified, diverse and independent nominees, including one representative from Prescience Point, are committed to rigorous oversight of the Company’s management, operations, business strategy, and value-creation process. Importantly, our three non-Prescience nominees collectively have decades of experience as executives and directors of well-performing biopharma companies, many of which were eventually sold on their watch. We have provided detailed biographies of each of our nominees below.

Biographies of Prescience Point’s Nominees (in alphabetical order):

Eiad Asbahi

Mr. Eiad Asbahi is currently the managing member of Prescience Point Capital Management, LLC, which he founded in 2009. Prior to founding Prescience Point, Mr. Asbahi was a consultant with the investment firm Kinderhook Partners from 2008 to 2009. At Kinderhook, Mr. Asbahi focused exclusively on analyzing small-cap equities, identifying undervalued companies with exceptional growth prospects or impending catalysts to unlock intrinsic value. Before his time at Kinderhook, Mr. Asbahi served as a consultant at Cohanzick Management in 2008, analyzing companies across the capital structure, with a focus on high yield and distressed debt, capital arbitrage and special situation equities. Mr. Asbahi began his career as an analyst with Sand Spring Capital in 2004, where he worked until 2008. He received a B.S. in Microbiology from Louisiana State University, summa cum laude, his MBA from Louisiana State University in 2006, graduating at the top of his class, and is a Chartered Financial Analyst (CFA®) holder.

Alfred G. Merriweather

Mr. Alfred G. Merriweather is currently a retired financial executive. Since January 2021, he has served as director, chair of the Board and chair of the Audit Committee of Cadex Genomics, Corp., a privately held molecular diagnostic company. Mr. Merriweather has spent over thirty years in chief financial officer roles in a number of life science and medical technology companies. Most recently, from 2017 to 2019, he was the CFO of Adamas Pharmaceuticals, Inc., a publicly traded pharmaceutical company focused on neurologic disorders. Prior to his employment by Adamas, Mr. Merriweather served as CFO of RainDance Technologies, Inc., a life science tools company, from 2013 to 2017. Mr. Merriweather has also served as CFO to several other device, tools, and diagnostic companies. These include clinical lab companies such as Verinata Health, Inc., Celera Corporation and Monogram BioSciences, Inc., as well as the medical device companies Laserscope and Symphonix Devices Inc. He began his career with Price Waterhouse as a chartered accountant in London, England and San Jose, California, and received his B.A. in Economics from the University of Cambridge in 1975.

Charlotte E. Sibley

Ms. Charlotte E. Sibley is currently the President of Sibley Associates, LLC. Since 2018, she has also served on the board of directors of Advicenne, SA, a publicly-traded French specialty pharmaceutical company, where she was a member of the Remuneration Committee. Currently, Ms. Sibley is also a director and chair of the Compensation Committee of the Fort Hill Company, a position she has held since 2015. Ms. Sibley has over forty years of experience in the biopharmaceutical industry. Recently, she served on the board of directors of Taconic Biosciences, Inc., from 2013 to 2019 where she chaired the Nomination and Governance Committee. Prior to Taconic, Ms. Sibley was a director of the American Pacific Corporation from 2010 to 2014. Ms. Sibley began her career in the pharmaceutical industry as a market research manager for Pfizer in 1970, and held several managerial positions at companies such as Johnson & Johnson, the Medical Economics Company, and Bristol-Myers Squibb, and later held executive positions at Pfizer, Millennium Pharmaceuticals, and Shire plc. Ms. Sibley received her A.B. in French Language and Literature from Middlebury College in 1968 and her MBA from the University of Chicago Booth School of Business in 1970.

William F. Spengler

Mr. William F. Spengler is currently retired and working part time as a partner for Frederick Fox, LLC, an executive search firm, a position he has held since May 2020. Prior to his retirement, Mr. Spengler served on the board of directors of Endo International plc, a publicly traded pharmaceutical company, from 2008 to 2017. While on the board, Mr. Spengler was chair of the Audit Committee and a member of the Research & Development Committee. He has 14 years of experience as chief financial officer of multiple companies, including Smith & Wesson Brands Inc., MGI Pharma, Inc., and Guilford Pharmaceuticals, Inc., Earthshell Corporation, and Sweetheart Holdings. He also served as president of Chromadex from 2012 to 2015 and Osteo Implant Technologies from 2001 to 2003. Mr. Spengler began his career with Bristol-Myers Squibb, where he worked for fourteen years, before serving as vice president of finance in the International Group and later the Power Tools Group of Black and Decker, before moving to the Sweetheart Cup Company. Mr. Spengler received his MBA from the New York University Stern School of Business in 1980 and his B.A. in Economics from Yale University in 1977.

We believe the addition of the above nominees to the Board is critical to help put MDXG on the right path to maximize value for all shareholders.

For updates and shareholder information, follow @PresciencePoint on Twitter or www.presciencepoint.com

Sincerely,

Eiad Asbahi

Prescience Point Capital Management, LLC

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Prescience Investment Group, LLC d/b/a Prescience Point Capital Management LLC, Prescience Partners, LP, Prescience Point Special Opportunity LP, Prescience Capital, LLC, Eiad Asbahi, Alfred G. Merriweather, Charlotte E. Sibley and William F. Spengler (all of the foregoing, collectively the “Participants”) intend to file with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying form of GOLD proxy to be used in connection with the solicitation of proxies from the shareholders of MiMedx Group, Inc. (the “Company”). All shareholders of the Company are advised to read the definitive proxy statement and other documents related to the solicitation of proxies by the Participants when they become available, as they will contain important information, including additional information related to the Participants. The definitive proxy statement and an accompanying GOLD proxy card will be furnished to some or all of the Company’s shareholders and will be, along with other relevant documents, available at no charge on the SEC website at http://www.sec.gov/.

Information about the Participants and a description of their direct or indirect interests by security holdings is contained in a Schedule 14A filed by the Participants with the Securities and Exchange Commission on April 16, 2021. This document is available free of charge from the source indicated above.

Disclaimer

This material does not constitute an offer to sell or a solicitation of an offer to buy any of the securities described herein in any state to any person. In addition, the discussions and opinions in this press release are for general information only and are not intended to provide investment advice. All statements contained in this press release that are not clearly historical in nature or that necessarily depend on future events are “forward-looking statements,” which are not guarantees of future performance or results, and the words “anticipate,” “believe,” “expect,” “potential,” “could,” “opportunity,” “estimate,” and similar expressions are generally intended to identify forward-looking statements. The projected results and statements contained in this press release that are not historical facts are based on current expectations, speak only as of the date of this press release and involve risks that may cause the actual results to be materially different. Certain information included in this material is based on data obtained from sources considered to be reliable. No representation is made with respect to the accuracy or completeness of such data, and any analyses provided to assist the recipient of this presentation in evaluating the matters described herein may be based on subjective assessments and assumptions and may use one among alternative methodologies that produce different results. Accordingly, any analyses should also not be viewed as factual and also should not be relied upon as an accurate prediction of future results. All figures are unaudited estimates and subject to revision without notice. Prescience Point disclaims any obligation to update the information herein and reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Past performance is not indicative of future results.

About Prescience Point Capital Management

Prescience Point Capital Management is a private investment manager that employs forensic investigative techniques to unearth significant mispricing in global markets. It specializes in extensive investigations of difficult-to-analyze public companies in order to uncover significant elements of the business that have been overlooked or ignored by others.

Prescience Point manages private funds on behalf of its clients and principals and takes positions both long and short in support of its research. Prescience Point invests across a broad set of equities that it believes have abnormally large disparities between what their underlying businesses are intrinsically worth and what their securities sell for. The firm was founded by investor Eiad Asbahi in 2009 and is headquartered in Baton Rouge, LA. Prescience Point Capital Management is a registered investment advisor with the State of Louisiana. Follow @PresciencePoint.

Investor Contacts

Jason Alexander / Bruce Goldfarb

Okapi Partners LLC

212-297-0720

info@okapipartners.com

MiMedx Announces Comprehensive Board Refreshment Plan in Cooperation with Prescience Point

MARIETTA, Ga., May 30, 2019 /PRNewswire/ — MiMedx Group, Inc. (OTC PINK: MDXG) (“MiMedx” or the “Company“), an industry leader in advanced wound care and an emerging therapeutic biologics company, today announced that the Company’s board of directors (the “Board“) has adopted a comprehensive plan to refresh the composition of the Board. The plan was developed by the Board in cooperation with one of the Company’s largest shareholders, Prescience Point Capital Management LLC (“Prescience Point“), and follows the completion of the Audit Committee’s independent investigation into alleged wrongdoing by the prior senior management team and the engagement of BDO USA, LLP as the Company’s new independent registered public accounting firm.

Under the plan, six new directors, including MiMedx’s new CEO, Timothy R. Wright, would be added to the Board. As a result, Class II and Class III of the Board would consist entirely of new directors after the Company’s 2019 annual meeting of shareholders. The refreshment plan includes the appointment of three of Prescience Point’s nominees, including M. Kathleen Behrens Wilsey, Ph.D. as the new Chairwoman of the Board, as well as K. Todd Newton, who is expected to become the Chairman of the Audit Committee after the Company’s 2019 annual meeting of shareholders.

“The MiMedx Board and the current senior leadership team have been working tirelessly to address the fallout from the actions of the prior senior management team and get the Company back on track,” said Charles R. Evans, Chairman of the Board. “Now that we have made substantial progress on these fronts, it is time to begin the Board transition and refreshment process. We are pleased to have worked collaboratively with Prescience Point to identify and add new directors who bring exceptional experience and track records to MiMedx. With the Audit Committee’s investigation complete and a plan to refresh the Board in place, the Company is now in a position to focus on its future and enhance its business, for the benefit of all stakeholders.”

“We welcome the comprehensive plan to refresh the Board, and we look forward to MiMedx’s future under new leadership. We are pleased that our cooperation has resulted in a reconstituted Board, with the addition of six new directors with valuable industry experience, relationships and reputational capital,” said Eiad Asbahi, Founder and Managing Partner of Prescience Point. “We invested in MiMedx because we believe the Company has immense potential as a leader in advanced wound care and therapeutic biologics. We believe MiMedx is on the path to unlock substantial shareholder value and secure a thriving future for the Company.”

Under the refreshment plan, Prescience Point nominee M. Kathleen Behrens Wilsey, Ph.D. will be appointed or nominated for election to the Board and is expected to be named the new Chairwoman of the Board. Dr. Behrens Wilsey is currently the Chairwoman of Sarepta Therapeutics, Inc. (SRPT), a multi-billion-dollar medical research and drug development company focused on the discovery and development of unique RNA-targeted therapeutics for the treatment of rare neuromuscular diseases. Dr. Behrens Wilsey previously served on the boards of Amylin Pharmaceuticals, Inc. (formerly AMLN) and Abgenix, Inc. (formerly ABGX).

In addition to Dr. Behrens Wilsey, the Board will also appoint, or nominate for election to the Board, Richard J. Barry, James L. Bierman, K. Todd Newton, Mr. Wright and another director who will be recruited by the Company and Prescience Point. Complete biographies of the anticipated new directors appear at the end of this press release.

The Company expects to file its preliminary proxy materials for its 2018 Annual Meeting today. The Board encourages shareholders to wait to receive the Company’s proxy materials and the Company’s BLUE proxy card before voting.

Sidley Austin LLP is acting as legal advisor to MiMedx. Olshan Frome Wolosky LLP is acting as legal advisor to Prescience Point.

About Richard J. Barry

Mr. Barry has served as a director of Elcelyx Therapeutics, Inc., a private pharmaceutical company, since February 2013and has served as a Managing Member of GSM Fund, LLC, a fund established for the sole purpose of investing in Elcelyx Therapeutics, since February 2013. Earlier in his career, he was a founding member of Eastbourne Capital Management LLC, a large equity hedge fund investing in a variety of industries, including health care, and served as the Managing General Partner and Portfolio Manager from 1999 to its close in 2010. Prior to that, he was a Portfolio Manager and Managing Director of Robertson Stephens Investment Management, an investment company, from 1995 until 1999. Before that, Mr. Barry spent over 13 years in various roles in institutional equity and investment management firms, including Lazard Freres, Legg Mason and Merrill Lynch. Mr. Barry has served as a director of Sarepta Therapeutics, Inc. (SRPT), a genetic medicine company, since June 2015, and he has been a Partner and Advisory Board member of the San Diego Padres since 2009. Mr. Barry previously served as a director of Cluster Wireless, LLC, a software company, from 2011 until 2014, and of BlackLight Power, Inc. (n/k/a Brilliant Light Power, Inc.), an energy research company, from 2009 until 2010. Mr. Barry holds a B.A. from Pennsylvania State University.

About M. Kathleen Behrens Wilsey, Ph.D.

Dr. Behrens Wilsey served as a member of the board of directors of each of Sarepta Therapeutics, Inc. (SRPT), a multi-billion dollar medical research and drug development company focused on the discovery and development of unique RNA-targeted therapeutics for the treatment of rare neuromuscular diseases, since March 2009 (Chairwoman of the Board since April 2015) and IGM Biosciences, Inc., a privately held biotechnology company, since January 2019. Dr. Behrens Wilsey has worked as an independent life sciences consultant and investor since December 2009. She served as the Co-Founder, President, Chief Executive Officer and as a director of the KEW Group Inc., a private oncology services company, from January 2012 until June 2014. Earlier in her career, Dr. Behrens Wilsey served as a general partner for selected venture funds for RS Investments, a mutual fund firm, from 1996 until December 2009. While Dr. Behrens Wilsey worked at RS Investments, from 1996 to 2002, she served as a managing director at the firm and, from 2003 to December 2009, she served as a consultant to the firm. During that time, Dr. Behrens Wilsey also served as a member of the President’s Council of Advisors on Science and Technology (PCAST), from 2001 to 2009 and as chairwoman of PCAST’s Subcommittee on Personalized Medicine, as well as the President, director and chairwoman of the National Venture Capital Association, an organization that advocates for public policy that supports the American Entrepreneurial ecosystem, from 1993 until 2000. Prior to that, she served as a general partner and managing director for Robertson Stephens & Co., an investment company, from 1983 through 1996. She served as a director of Amylin Pharmaceuticals, Inc. (formerly AMLN), a biopharmaceutical company, from 2009 until the company’s sale in 2012 to Bristol-Myers Squibb Co. Prior to that, she served on the board of directors Abgenix, Inc. (formerly ABGX), a biopharmaceutical company, from 2001 until the company was sold to Amgen, Inc. in 2006. From 1997 to 2005, Dr. Behrens was a director of the Board on Science, Technology and Economic Policy for the National Research Council. Dr. Behrens Wilsey was also a Co-Founder of the Coalition for 21st Century Medicine, a trade association for new generation diagnostics companies. Dr. Behrens Wilsey holds a B.S. in Biology and a Ph.D. in Microbiology from the University of California, Davis.

About James L. Bierman

Mr. Bierman served as President and Chief Executive Officer of Owens & Minor, Inc., a Fortune 500 company and a leading distributor of medical and surgical supplies, from September 2014 to June 2015. Previously, he served in various other senior roles at Owens & Minor, including President and Chief Operating Officer from August 2013 to September 2014, Executive Vice President and Chief Operating Officer from March 2012 to August 2013, Executive Vice President and Chief Financial Officer from April 2011 to March 2012, and Senior Vice President and Chief Financial Officer from June 2007 to April 2011. From 2001 to 2004, Mr. Bierman served as Executive Vice President and Chief Financial Officer at Quintiles Transnational Corp. Prior to joining Quintiles Transnational, Mr. Bierman was a partner at Arthur Andersen LLP. Mr. Bierman currently serves on the board of directors of Tenet Healthcare Corporation (THC) and previously served on the boards of directors of Owens & Minor, Inc. (OMI) and Team Health Holdings, Inc. (formerly TMH). Mr. Bierman earned his B.A. from Dickinson College and his M.B.A. at Cornell University’s Johnson Graduate School of Management.

About K. Todd Newton

Mr. Newton has, since 2014, served as Chief Executive Officer and a member of the board of directors of Apollo Endosurgery, Inc. (APEN), a leader in the field of gastrointestinal therapeutic endoscopy. From 2009 to 2014, Mr. Newton served as Executive Vice President and Chief Financial Officer at ArthroCare Corporation (ARTC), a medical device company, including from 2013 as Chief Operating Officer. Prior to his leadership at ArthroCare, Mr. Newton served in a number of executive officer roles, including President and Chief Executive Officer, at Synenco Energy, Inc., a Canadian oil sands company. From 1994 to 2004, Mr. Newton was a Partner at Deloitte & Touche LLP. Mr. Newton holds a B.B.A. in accounting from the University of Texas at San Antonio.

About Timothy R. Wright

Mr. Wright became MiMedx’s Chief Executive Officer, effective as of May 13, 2019. Previously, Mr. Wright served as a Partner at Signal Hill Advisors, LLC, a consulting practice, since February 2011. Mr. Wright served as President and Chief Executive Officer of M2Gen Corp., a privately held cancer and health informatics company, between July 2017 and September 2018. Prior to M2Gen Corp., Mr. Wright served as Executive Vice President, Mergers and Acquisitions, Strategy and Innovation for Teva Pharmaceutical Industries Ltd. (“Teva”), a pharmaceutical company specializing in generic medicines, from April 2015 until August 2017. Before Teva, Mr. Wright was the founding partner of The Ohio State University Comprehensive Cancer Drug Development Institute. Mr. Wright also served as Chairman, Interim Chief Executive Officer and a director of Curaxis Pharmaceutical Corporation (“Curaxis”), a pharmaceutical company specializing in the development of drugs for the treatment of Alzheimer’s disease and various cancers, from July 2011 to July 2012. Curaxis had been experiencing financial difficulties prior to Mr. Wright’s tenure and, as a result, the company filed for Chapter 11 bankruptcy in July 2012. Mr. Wright has been a director of Agenus, Inc. (Nasdaq: AGEN), an immune oncology company, since 2006 and its lead director since 2009. Mr. Wright also serves as Chairperson of The Ohio State University Comprehensive Cancer Center Drug Development Institute, serves as director of The Ohio State Innovation Foundation and sits on The Ohio State University College of Pharmacy Dean’s Corporate Council. Mr. Wright earned a Bachelor’s of Science in Marketing from The Ohio State University.

About MiMedx

MiMedx® is an industry leader in advanced wound care and an emerging therapeutic biologics company developing and distributing human placental tissue allografts with patent-protected processes for multiple sectors of healthcare. The Company processes the human placental tissue utilizing its proprietary PURION® process methodology, among other processes, to produce allografts by employing aseptic processing techniques in addition to terminal sterilization. MiMedx has supplied over 1.5 million allografts to date. For additional information, please visit www.mimedx.com.

About Prescience Point Capital Management

Prescience Point Capital Management is a private investment manager that employs forensic investigative techniques to unearth significant mispricings in global markets. It specializes in extensive investigations of difficult-to-analyze public companies in order to uncover significant elements of the business that have been overlooked or ignored by others.

Prescience Point manages private funds on behalf of its clients and principals and takes positions both long and short in support of its research. Prescience Point invests across a broad set of equities that it believes have abnormally large disparities between what their underlying businesses are intrinsically worth and what their securities sell for. The firm was founded by investor Eiad Asbahi in 2009 and is headquartered in Baton Rouge, LA. Prescience Point Capital Management is a registered investment advisor with the State of Louisiana. Follow @PresciencePoint.

Safe Harbor Statement

This press release includes forward-looking statements, including statements regarding the plan of MiMedx Group, Inc. (the “Company“) to refresh the Board, the effects of such refreshment on the Company and expectations with respect to Board leadership. Forward-looking statements may be identified by words such as “believe,” “expect,” “may,” “plan,” “potential,” “will,” “would” and similar expressions and are based on current beliefs and expectations. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements.

Actual results may differ materially from those set forth in the forward-looking statements as a result of various factors, including the results of any election of Class II or Class III directors. There is no assurance that the Board’s nominees will be elected at the Company’s 2018 annual meeting of shareholders (the “2018 Annual Meeting“) or the Company’s 2019 annual meeting of shareholders. Any forward-looking statements speak only as of the date of this press release, and except as required by law, the Company assumes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Important Information

The Company intends to file a definitive proxy statement and associated BLUE proxy card in connection with the solicitation of proxies for the 2018 Annual Meeting with the Securities and Exchange Commission (the “SEC“). Details concerning the nominees of the Company’s board of directors for election at the 2018 Annual Meeting will be included in the proxy statement. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive proxy statement and other documents filed by the Company free of charge from the SEC’s website at www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the definitive proxy statement and other relevant filed documents from the “SEC Filings” section of the Company’s website at www.mimedx.com.

Participants in the Solicitation

The Company, its directors, its director nominees and certain of its executive officers are participants in the solicitation of proxies from shareholders in respect of the 2018 Annual Meeting. Information regarding the names of the Company’s directors, director nominees and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Company’s Current Report on Form 8-K filed with the SEC on May 30, 2019. Additional information regarding the interests of these participants in any proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC, if and when they become available.

Contacts

Investors:

Hilary Dixon

Corporate & Investor Communications

770.651.9066

investorrelations@mimedx.com

Media:

Joele Frank, Wilkinson Brimmer Katcher

Andy Brimmer / Jed Repko / Annabelle Rinehart

212.355.4449

Media for Prescience Point:

Dukas Linden Public Relations

Zach Kouwe

212-704-7385

presciencepoint@dlpr.com

SOURCE MiMedx Group, Inc.

Related Links

MARIETTA, Ga., May 30, 2019 /PRNewswire/ — MiMedx Group, Inc. (OTC PINK: MDXG) (“MiMedx” or the “Company“), an industry leader in advanced wound care and an emerging therapeutic biologics company, today announced that the Company’s board of directors (the “Board“) has adopted a comprehensive plan to refresh the composition of the Board. The plan was developed by the Board in cooperation with one of the Company’s largest shareholders, Prescience Point Capital Management LLC (“Prescience Point“), and follows the completion of the Audit Committee’s independent investigation into alleged wrongdoing by the prior senior management team and the engagement of BDO USA, LLP as the Company’s new independent registered public accounting firm.

Under the plan, six new directors, including MiMedx’s new CEO, Timothy R. Wright, would be added to the Board. As a result, Class II and Class III of the Board would consist entirely of new directors after the Company’s 2019 annual meeting of shareholders. The refreshment plan includes the appointment of three of Prescience Point’s nominees, including M. Kathleen Behrens Wilsey, Ph.D. as the new Chairwoman of the Board, as well as K. Todd Newton, who is expected to become the Chairman of the Audit Committee after the Company’s 2019 annual meeting of shareholders.

“The MiMedx Board and the current senior leadership team have been working tirelessly to address the fallout from the actions of the prior senior management team and get the Company back on track,” said Charles R. Evans, Chairman of the Board. “Now that we have made substantial progress on these fronts, it is time to begin the Board transition and refreshment process. We are pleased to have worked collaboratively with Prescience Point to identify and add new directors who bring exceptional experience and track records to MiMedx. With the Audit Committee’s investigation complete and a plan to refresh the Board in place, the Company is now in a position to focus on its future and enhance its business, for the benefit of all stakeholders.”

“We welcome the comprehensive plan to refresh the Board, and we look forward to MiMedx’s future under new leadership. We are pleased that our cooperation has resulted in a reconstituted Board, with the addition of six new directors with valuable industry experience, relationships and reputational capital,” said Eiad Asbahi, Founder and Managing Partner of Prescience Point. “We invested in MiMedx because we believe the Company has immense potential as a leader in advanced wound care and therapeutic biologics. We believe MiMedx is on the path to unlock substantial shareholder value and secure a thriving future for the Company.”

Under the refreshment plan, Prescience Point nominee M. Kathleen Behrens Wilsey, Ph.D. will be appointed or nominated for election to the Board and is expected to be named the new Chairwoman of the Board. Dr. Behrens Wilsey is currently the Chairwoman of Sarepta Therapeutics, Inc. (SRPT), a multi-billion-dollar medical research and drug development company focused on the discovery and development of unique RNA-targeted therapeutics for the treatment of rare neuromuscular diseases. Dr. Behrens Wilsey previously served on the boards of Amylin Pharmaceuticals, Inc. (formerly AMLN) and Abgenix, Inc. (formerly ABGX).

In addition to Dr. Behrens Wilsey, the Board will also appoint, or nominate for election to the Board, Richard J. Barry, James L. Bierman, K. Todd Newton, Mr. Wright and another director who will be recruited by the Company and Prescience Point. Complete biographies of the anticipated new directors appear at the end of this press release.

The Company expects to file its preliminary proxy materials for its 2018 Annual Meeting today. The Board encourages shareholders to wait to receive the Company’s proxy materials and the Company’s BLUE proxy card before voting.

Sidley Austin LLP is acting as legal advisor to MiMedx. Olshan Frome Wolosky LLP is acting as legal advisor to Prescience Point.

About Richard J. Barry

Mr. Barry has served as a director of Elcelyx Therapeutics, Inc., a private pharmaceutical company, since February 2013and has served as a Managing Member of GSM Fund, LLC, a fund established for the sole purpose of investing in Elcelyx Therapeutics, since February 2013. Earlier in his career, he was a founding member of Eastbourne Capital Management LLC, a large equity hedge fund investing in a variety of industries, including health care, and served as the Managing General Partner and Portfolio Manager from 1999 to its close in 2010. Prior to that, he was a Portfolio Manager and Managing Director of Robertson Stephens Investment Management, an investment company, from 1995 until 1999. Before that, Mr. Barry spent over 13 years in various roles in institutional equity and investment management firms, including Lazard Freres, Legg Mason and Merrill Lynch. Mr. Barry has served as a director of Sarepta Therapeutics, Inc. (SRPT), a genetic medicine company, since June 2015, and he has been a Partner and Advisory Board member of the San Diego Padres since 2009. Mr. Barry previously served as a director of Cluster Wireless, LLC, a software company, from 2011 until 2014, and of BlackLight Power, Inc. (n/k/a Brilliant Light Power, Inc.), an energy research company, from 2009 until 2010. Mr. Barry holds a B.A. from Pennsylvania State University.

About M. Kathleen Behrens Wilsey, Ph.D.

Dr. Behrens Wilsey served as a member of the board of directors of each of Sarepta Therapeutics, Inc. (SRPT), a multi-billion dollar medical research and drug development company focused on the discovery and development of unique RNA-targeted therapeutics for the treatment of rare neuromuscular diseases, since March 2009 (Chairwoman of the Board since April 2015) and IGM Biosciences, Inc., a privately held biotechnology company, since January 2019. Dr. Behrens Wilsey has worked as an independent life sciences consultant and investor since December 2009. She served as the Co-Founder, President, Chief Executive Officer and as a director of the KEW Group Inc., a private oncology services company, from January 2012 until June 2014. Earlier in her career, Dr. Behrens Wilsey served as a general partner for selected venture funds for RS Investments, a mutual fund firm, from 1996 until December 2009. While Dr. Behrens Wilsey worked at RS Investments, from 1996 to 2002, she served as a managing director at the firm and, from 2003 to December 2009, she served as a consultant to the firm. During that time, Dr. Behrens Wilsey also served as a member of the President’s Council of Advisors on Science and Technology (PCAST), from 2001 to 2009 and as chairwoman of PCAST’s Subcommittee on Personalized Medicine, as well as the President, director and chairwoman of the National Venture Capital Association, an organization that advocates for public policy that supports the American Entrepreneurial ecosystem, from 1993 until 2000. Prior to that, she served as a general partner and managing director for Robertson Stephens & Co., an investment company, from 1983 through 1996. She served as a director of Amylin Pharmaceuticals, Inc. (formerly AMLN), a biopharmaceutical company, from 2009 until the company’s sale in 2012 to Bristol-Myers Squibb Co. Prior to that, she served on the board of directors Abgenix, Inc. (formerly ABGX), a biopharmaceutical company, from 2001 until the company was sold to Amgen, Inc. in 2006. From 1997 to 2005, Dr. Behrens was a director of the Board on Science, Technology and Economic Policy for the National Research Council. Dr. Behrens Wilsey was also a Co-Founder of the Coalition for 21st Century Medicine, a trade association for new generation diagnostics companies. Dr. Behrens Wilsey holds a B.S. in Biology and a Ph.D. in Microbiology from the University of California, Davis.

About James L. Bierman

Mr. Bierman served as President and Chief Executive Officer of Owens & Minor, Inc., a Fortune 500 company and a leading distributor of medical and surgical supplies, from September 2014 to June 2015. Previously, he served in various other senior roles at Owens & Minor, including President and Chief Operating Officer from August 2013 to September 2014, Executive Vice President and Chief Operating Officer from March 2012 to August 2013, Executive Vice President and Chief Financial Officer from April 2011 to March 2012, and Senior Vice President and Chief Financial Officer from June 2007 to April 2011. From 2001 to 2004, Mr. Bierman served as Executive Vice President and Chief Financial Officer at Quintiles Transnational Corp. Prior to joining Quintiles Transnational, Mr. Bierman was a partner at Arthur Andersen LLP. Mr. Bierman currently serves on the board of directors of Tenet Healthcare Corporation (THC) and previously served on the boards of directors of Owens & Minor, Inc. (OMI) and Team Health Holdings, Inc. (formerly TMH). Mr. Bierman earned his B.A. from Dickinson College and his M.B.A. at Cornell University’s Johnson Graduate School of Management.

About K. Todd Newton

Mr. Newton has, since 2014, served as Chief Executive Officer and a member of the board of directors of Apollo Endosurgery, Inc. (APEN), a leader in the field of gastrointestinal therapeutic endoscopy. From 2009 to 2014, Mr. Newton served as Executive Vice President and Chief Financial Officer at ArthroCare Corporation (ARTC), a medical device company, including from 2013 as Chief Operating Officer. Prior to his leadership at ArthroCare, Mr. Newton served in a number of executive officer roles, including President and Chief Executive Officer, at Synenco Energy, Inc., a Canadian oil sands company. From 1994 to 2004, Mr. Newton was a Partner at Deloitte & Touche LLP. Mr. Newton holds a B.B.A. in accounting from the University of Texas at San Antonio.

About Timothy R. Wright

Mr. Wright became MiMedx’s Chief Executive Officer, effective as of May 13, 2019. Previously, Mr. Wright served as a Partner at Signal Hill Advisors, LLC, a consulting practice, since February 2011. Mr. Wright served as President and Chief Executive Officer of M2Gen Corp., a privately held cancer and health informatics company, between July 2017 and September 2018. Prior to M2Gen Corp., Mr. Wright served as Executive Vice President, Mergers and Acquisitions, Strategy and Innovation for Teva Pharmaceutical Industries Ltd. (“Teva”), a pharmaceutical company specializing in generic medicines, from April 2015 until August 2017. Before Teva, Mr. Wright was the founding partner of The Ohio State University Comprehensive Cancer Drug Development Institute. Mr. Wright also served as Chairman, Interim Chief Executive Officer and a director of Curaxis Pharmaceutical Corporation (“Curaxis”), a pharmaceutical company specializing in the development of drugs for the treatment of Alzheimer’s disease and various cancers, from July 2011 to July 2012. Curaxis had been experiencing financial difficulties prior to Mr. Wright’s tenure and, as a result, the company filed for Chapter 11 bankruptcy in July 2012. Mr. Wright has been a director of Agenus, Inc. (Nasdaq: AGEN), an immune oncology company, since 2006 and its lead director since 2009. Mr. Wright also serves as Chairperson of The Ohio State University Comprehensive Cancer Center Drug Development Institute, serves as director of The Ohio State Innovation Foundation and sits on The Ohio State University College of Pharmacy Dean’s Corporate Council. Mr. Wright earned a Bachelor’s of Science in Marketing from The Ohio State University.

About MiMedx

MiMedx® is an industry leader in advanced wound care and an emerging therapeutic biologics company developing and distributing human placental tissue allografts with patent-protected processes for multiple sectors of healthcare. The Company processes the human placental tissue utilizing its proprietary PURION® process methodology, among other processes, to produce allografts by employing aseptic processing techniques in addition to terminal sterilization. MiMedx has supplied over 1.5 million allografts to date. For additional information, please visit www.mimedx.com.

About Prescience Point Capital Management

Prescience Point Capital Management is a private investment manager that employs forensic investigative techniques to unearth significant mispricings in global markets. It specializes in extensive investigations of difficult-to-analyze public companies in order to uncover significant elements of the business that have been overlooked or ignored by others.

Prescience Point manages private funds on behalf of its clients and principals and takes positions both long and short in support of its research. Prescience Point invests across a broad set of equities that it believes have abnormally large disparities between what their underlying businesses are intrinsically worth and what their securities sell for. The firm was founded by investor Eiad Asbahi in 2009 and is headquartered in Baton Rouge, LA. Prescience Point Capital Management is a registered investment advisor with the State of Louisiana. Follow @PresciencePoint.

Safe Harbor Statement

This press release includes forward-looking statements, including statements regarding the plan of MiMedx Group, Inc. (the “Company“) to refresh the Board, the effects of such refreshment on the Company and expectations with respect to Board leadership. Forward-looking statements may be identified by words such as “believe,” “expect,” “may,” “plan,” “potential,” “will,” “would” and similar expressions and are based on current beliefs and expectations. Forward-looking statements are subject to risks and uncertainties, and the Company cautions investors against placing undue reliance on such statements.

Actual results may differ materially from those set forth in the forward-looking statements as a result of various factors, including the results of any election of Class II or Class III directors. There is no assurance that the Board’s nominees will be elected at the Company’s 2018 annual meeting of shareholders (the “2018 Annual Meeting“) or the Company’s 2019 annual meeting of shareholders. Any forward-looking statements speak only as of the date of this press release, and except as required by law, the Company assumes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

Important Information

The Company intends to file a definitive proxy statement and associated BLUE proxy card in connection with the solicitation of proxies for the 2018 Annual Meeting with the Securities and Exchange Commission (the “SEC“). Details concerning the nominees of the Company’s board of directors for election at the 2018 Annual Meeting will be included in the proxy statement. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive proxy statement and other documents filed by the Company free of charge from the SEC’s website at www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the definitive proxy statement and other relevant filed documents from the “SEC Filings” section of the Company’s website at www.mimedx.com.

Participants in the Solicitation

The Company, its directors, its director nominees and certain of its executive officers are participants in the solicitation of proxies from shareholders in respect of the 2018 Annual Meeting. Information regarding the names of the Company’s directors, director nominees and executive officers and their respective interests in the Company by security holdings or otherwise is set forth in the Company’s Current Report on Form 8-K filed with the SEC on May 30, 2019. Additional information regarding the interests of these participants in any proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will also be included in any proxy statement and other relevant materials to be filed with the SEC, if and when they become available.

Contacts

Investors:

Hilary Dixon

Corporate & Investor Communications

770.651.9066

investorrelations@mimedx.com

Media:

Joele Frank, Wilkinson Brimmer Katcher

Andy Brimmer / Jed Repko / Annabelle Rinehart

212.355.4449

Media for Prescience Point:

Dukas Linden Public Relations

Zach Kouwe

212-704-7385

presciencepoint@dlpr.com

SOURCE MiMedx Group, Inc.